15+ Mortgage points

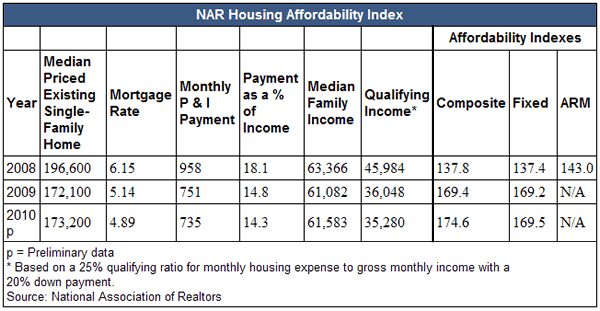

30 Year Mortgage - From 85600month 20 Year Mortgage - From 112100month. The 15-year rate averaged 212.

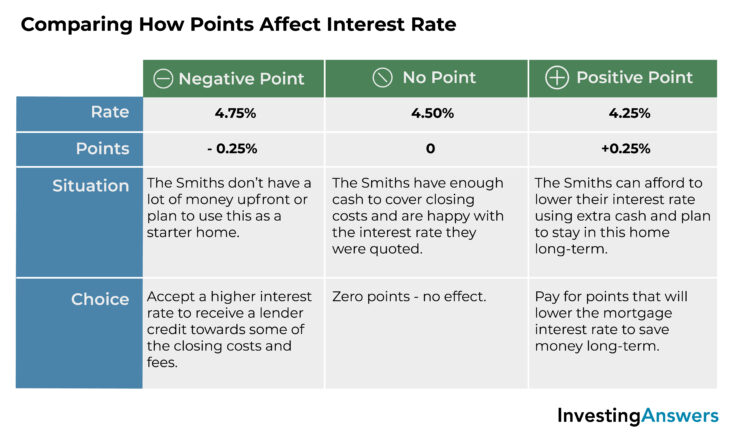

Real Canadian Mortgage Growth Points To Early 80s Style Meltdown Wolf Street

Ad Create an inviting borrower experience with the leading mortgage point-of-sale solution.

. Compare Offers Side by Side with LendingTree. Ad FHA VA Conventional HARP And Jumbo Mortgages Available. See Todays Rate Get The Best Rate In A 90 Day Period.

Ad Get the Right Housing Loan for Your Needs. Mortgage points come in two varieties. Paying no points is typically.

15 Year Mortgage Fees and Points Level Chart View Full Chart No data available Historical Data View and export this data back to 1991. Origination points and discount points. 5500 up from 5490 0010.

A basis point is equivalent to 001. Ad Create an inviting borrower experience with the leading mortgage point-of-sale solution. Mortgage points are fees you pay upfront to reduce your mortgage interest rate and by extension your monthly payment amount.

Basic Info 15 Year. This is the highest this rate has been since 2008 and the. Ad Were Americas 1 Online Lender.

Lock Your Rate Now With Quicken Loans. 197778 original total interest paid 185035 reduced total interest. Each point you buy typically lowers your interest rate by 025 percentage.

With one mortgage point youll drop that amount to 185035which saves you 12743 in total interest. Points are paid upfront. The term points is used to describe certain charges paid to obtain a home mortgage.

Now is the Time to Take Action and Lock your Rate. Both 10- and 15-year rates are at 55 which is nearly a point lower than rates for longer terms. So for every 100000 you borrow one mortgage point is worth 1000.

Make it easy to stay engaged and connected with borrowers throughout the loan lifecycle. On a 200000 loan each point costs 2000 which means that 175 points will cost 3500. The current average 30-year fixed mortgage rate is 602 according to Freddie Mac.

As a general rule one mortgage point is equal to 1 of the mortgage amount. Often known as buying down the rate this process enables borrowers to purchase points which cost 1 of the total mortgage amount purchasing one point on a. This process is also known as buying down.

Compare Your Best Mortgage Loans View Rates. Points may also be called loan origination fees maximum loan charges loan discount or discount points. The average APR on a 15-year fixed-rate mortgage rose 2 basis points to 5235 and the average APR for a 5-year adjustable-rate mortgage ARM fell 4 basis points to 5330.

Mortgage points are fees that you pay your mortgage lender upfront in order to reduce the interest rate on your loan and in turn your monthly payments. For most home buyers a 15-year mortgage payment plus existing debts will take up more than 43 to 50 of their monthly income which is the maximum DTI range most. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

In both cases each point is typically equal to 1 of the total amount mortgaged. 2 days ago30-year fixed mortgage rates. 17 hours ago15-year fixed mortgage rates.

Points are calculated in relation to the size of the loan with each point equal to 1 of the loan amount. The average 15-year fixed mortgage rate nationwide is 577 and the 15-year jumbo mortgage rate is 565 as of September 19 2022. Make it easy to stay engaged and connected with borrowers throughout the loan lifecycle.

The average APR on a 15-year fixed-rate mortgage rose 9 basis points to 5351 and the average APR for a 5-year adjustable-rate mortgage ARM fell 6 basis points to 5283. The current rate for a 15-year fixed-rate mortgage is 521 with 09 points paid an increase of 005 percentage points higher week-over-week. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

When you choose a 15 year fixed rate mortgage rather than the typical 30 year you benefit from a lower rate a chance to build more equity and less interest overall. The 30-year fixed-mortgage rate average is 610 which is an increase of 8 basis points compared to one week ago. If you choose not to buy mortgage points your interest rate will remain at 5125.

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

What Is Mortgage Life Insurance

What Are The Main Types Of Mortgage Lenders

Ex99 1 015 Jpg

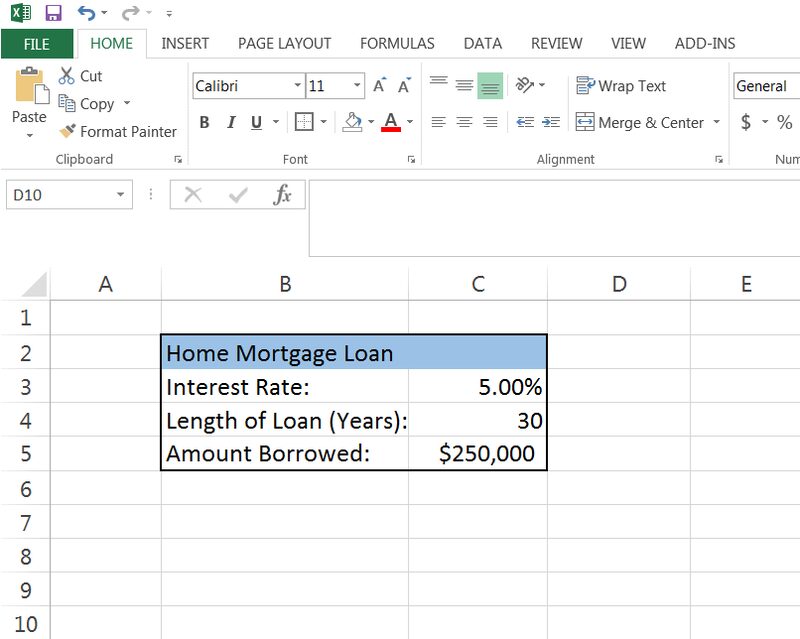

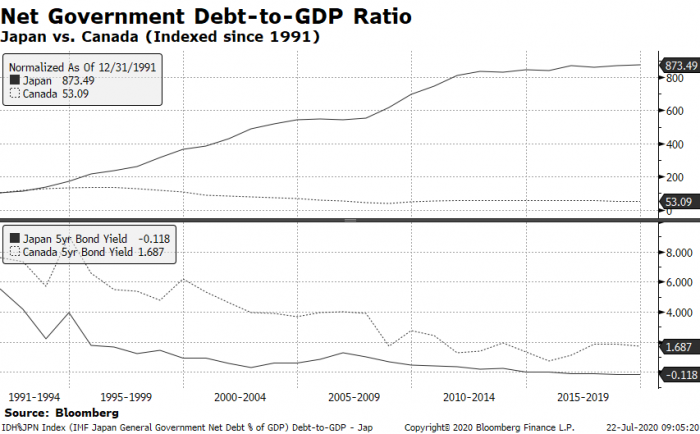

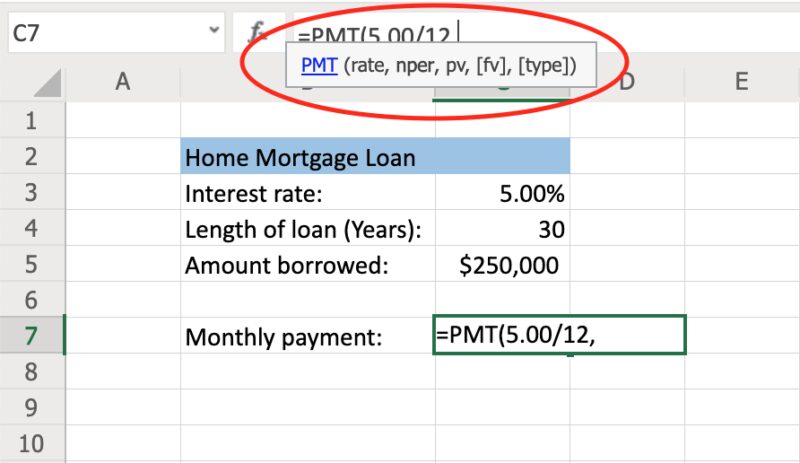

How To Calculate Monthly Loan Payments In Excel Investinganswers

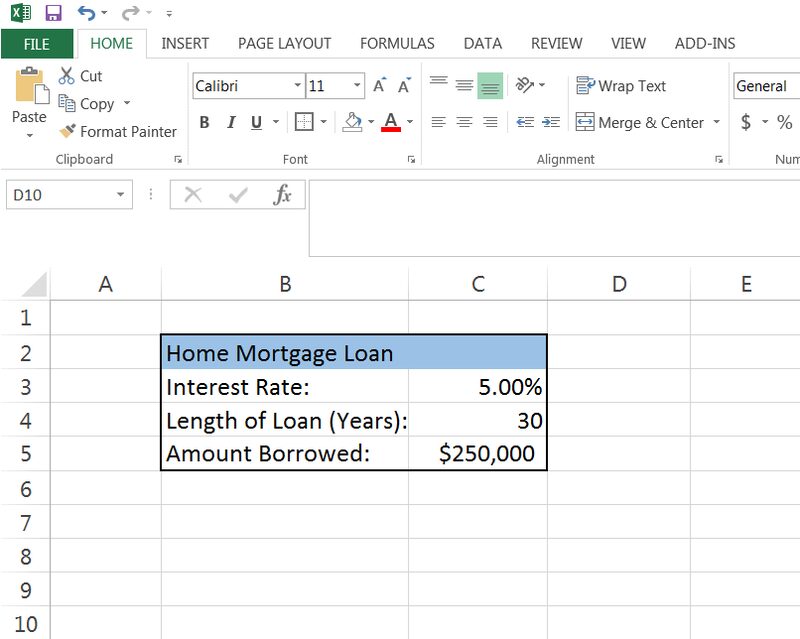

Negative Points Meaning Examples Investinganswers

When To Buy Mortgage Insurance Even When It S Not Required Ratespy Com

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How To Calculate Monthly Loan Payments In Excel Investinganswers

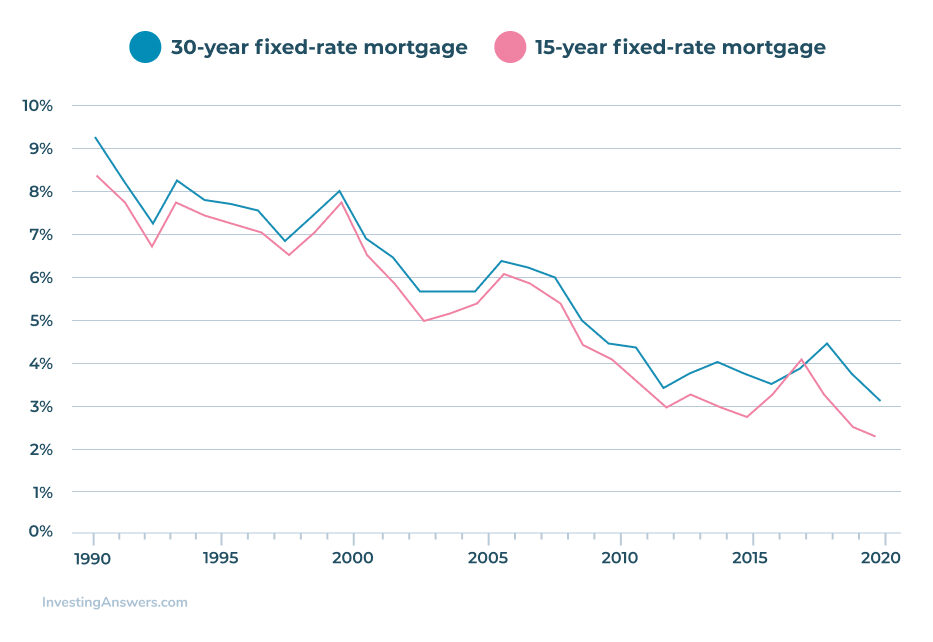

Historical Mortgage Rates In The Us Averages And Trends

When To Buy Mortgage Insurance Even When It S Not Required Ratespy Com

3

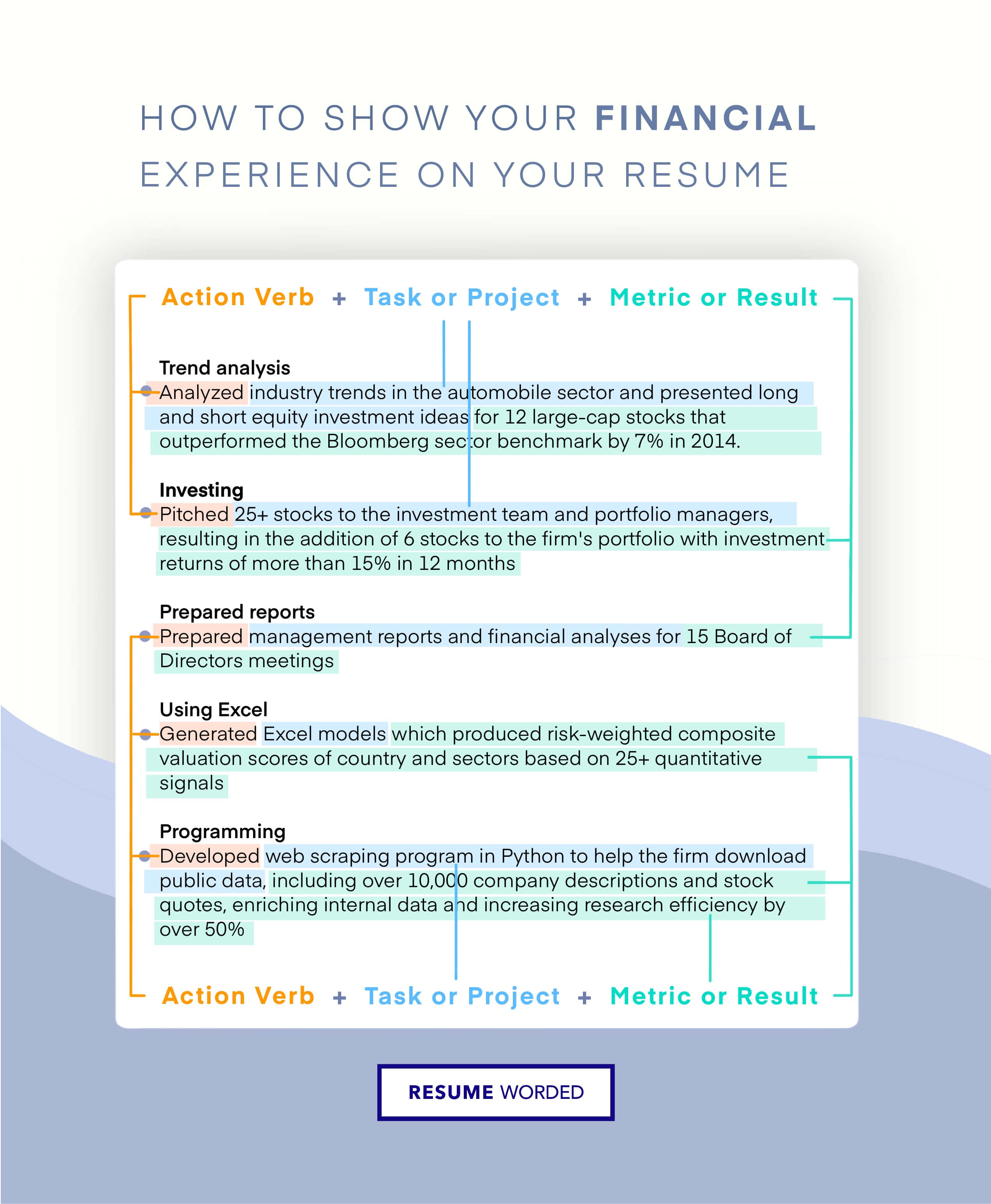

Resume Skills And Keywords For Loan Clerk Updated For 2022

.jpg)

Negative Points Meaning Examples Investinganswers

/adjustable_rate_mortgage_what_happens_when_interest_rates_go_up-5bfc386b46e0fb00511d43c5.jpg)

Adjustable Rate Mortgage What Happens When Interest Rates Go Up

How 8 Mortgage Rates Will Change The Face Of Homeownership