Calculate take home pay georgia

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia.

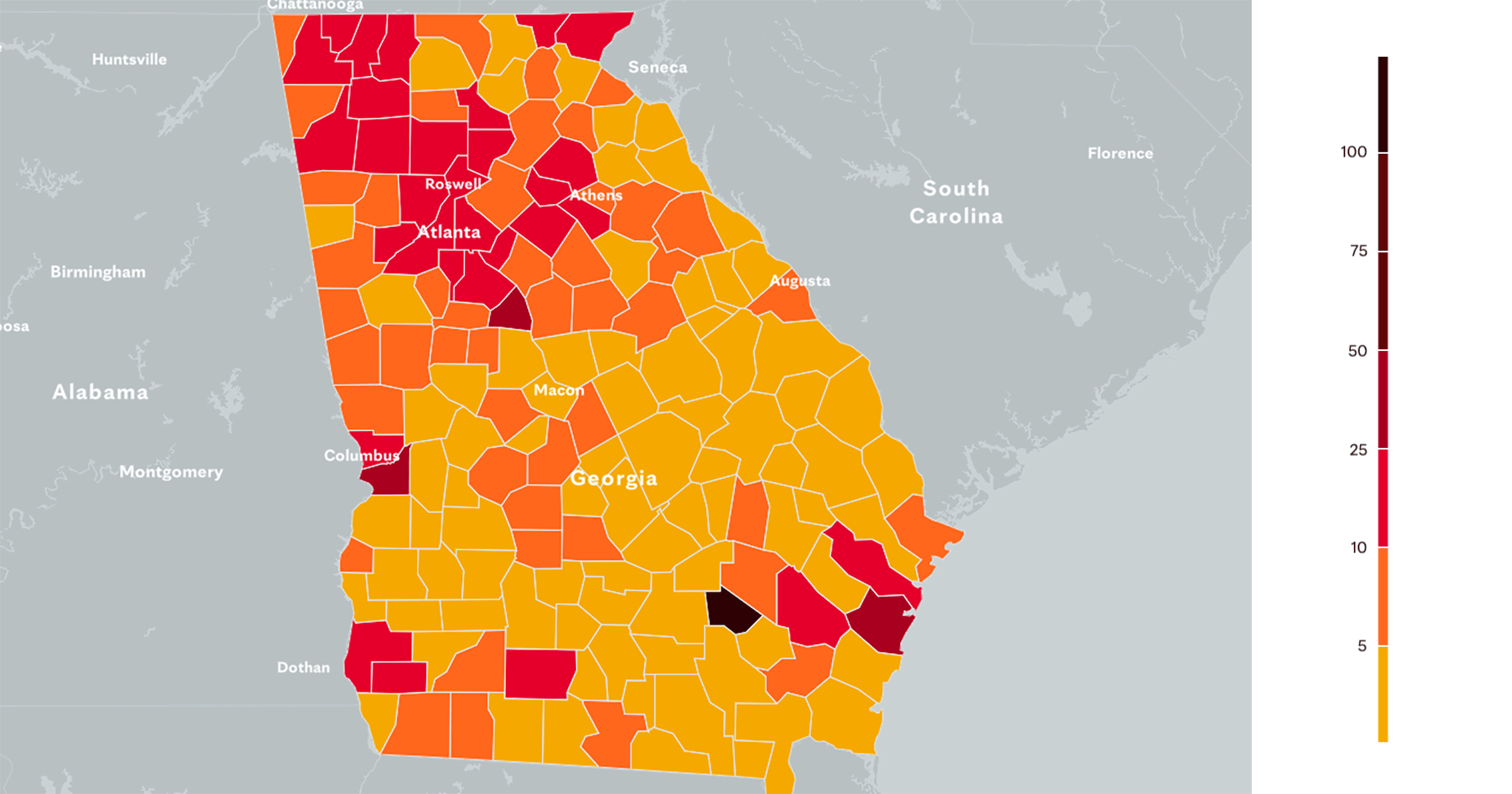

Georgia Coronavirus Map And Case Count The New York Times

It can also be used to help fill steps 3 and 4 of a W-4 form.

. Simply enter their federal and state W-4 information as. You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 202223. Georgia Income Tax Calculator Calculate your federal Georgia income taxes Updated for 2022 tax year on Aug 31.

Well do the math for youall you need to do is enter. All you have to do. Our 2022 GS Pay Calculator allows you to calculate the exact salary.

Its part of the larger Mesoamerican Barrier Reef. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Take home pay calculator georgia To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast. Work out your adjusted gross income. This free easy to use payroll calculator will calculate your take home pay.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. Georgia Salary Tax Calculator for the Tax Year 202223. For example if an.

For example if an employee earns 1500 per week the individuals. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull. Supports hourly salary income and multiple pay frequencies.

This Georgia hourly paycheck. Calculates Federal FICA Medicare and. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Figure out your filing status. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Calculate your take home pay after taxes.

University Bookstore Auxiliary Services

Georgia Covid 19 Map Tracking The Trends

University Of Georgia

Prepay

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Georgia Income Tax Calculator Smartasset

Georgia Paycheck Calculator Smartasset

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Georgia Traveler View Travelers Health Cdc

Georgia State College Of Law College Of Law

Georgia State University

Georgia Piedmont Technical College Georgia Piedmont Tech Exists To Strengthen The Workforce In Dekalb Newton And Rockdale Counties

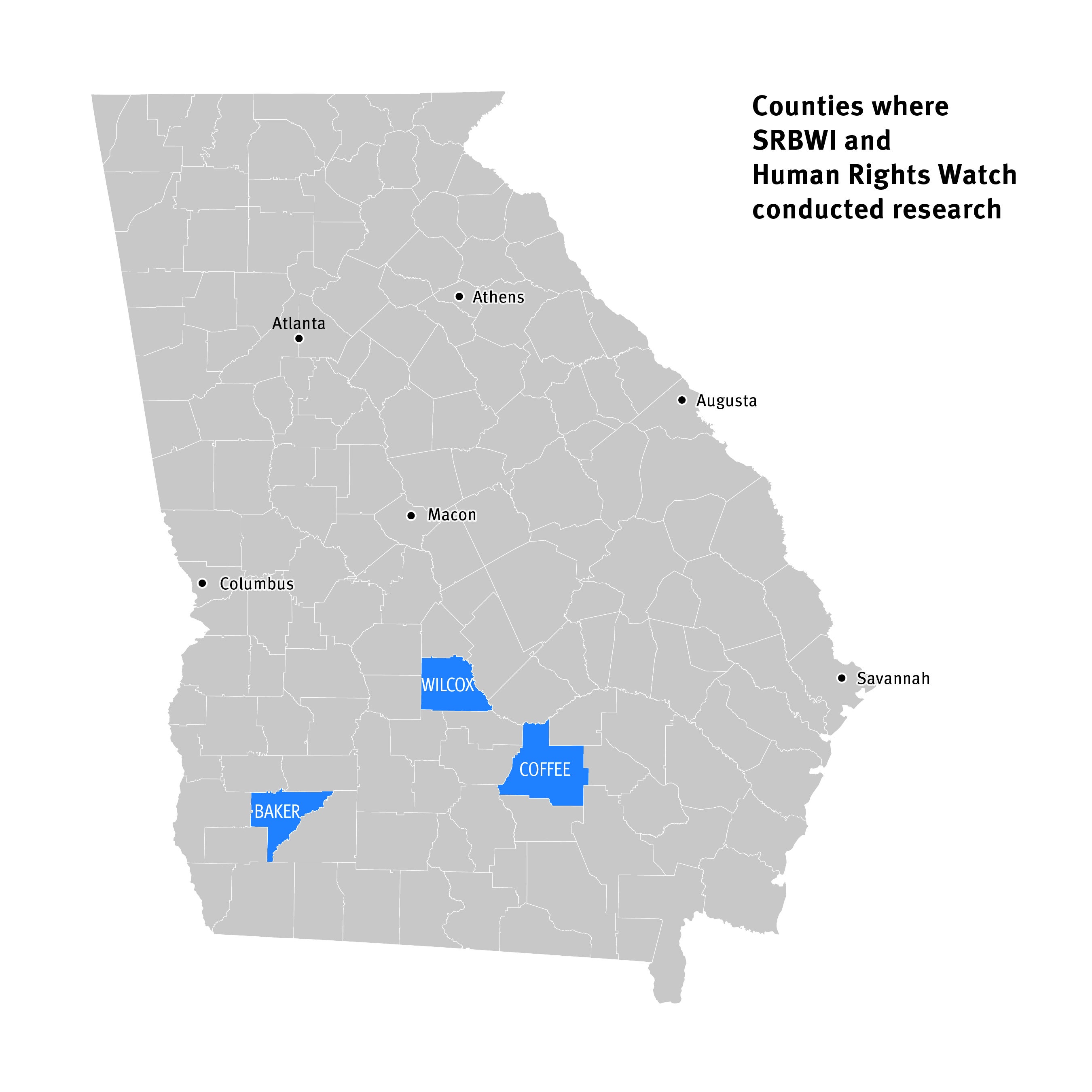

We Need Access Ending Preventable Deaths From Cervical Cancer In Rural Georgia Hrw

Georgia Coronavirus Map And Case Count The New York Times

Georgia Paycheck Calculator Smartasset

North Georgia Technical College

Hourly Paycheck Calculator Calculate Hourly Pay Adp