Tim tax salary calculator

Its so easy to. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

The adjusted annual salary can be calculated as.

. It is mainly intended for residents of the US. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. Taxable income Annual gross salary - Pension Provident RAF limited to 275 of salary limited to R350k - 20 of travel allowance You are taxed on 80 of the.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. That means that your net pay will be 43041 per year or 3587 per month. Did you work for an.

Your household income location filing status and number of personal. And is based on. Taxable income Annual gross salary - Pension Provident RAF limited to 275 of salary limited to R350k - 20 of travel allowance You are.

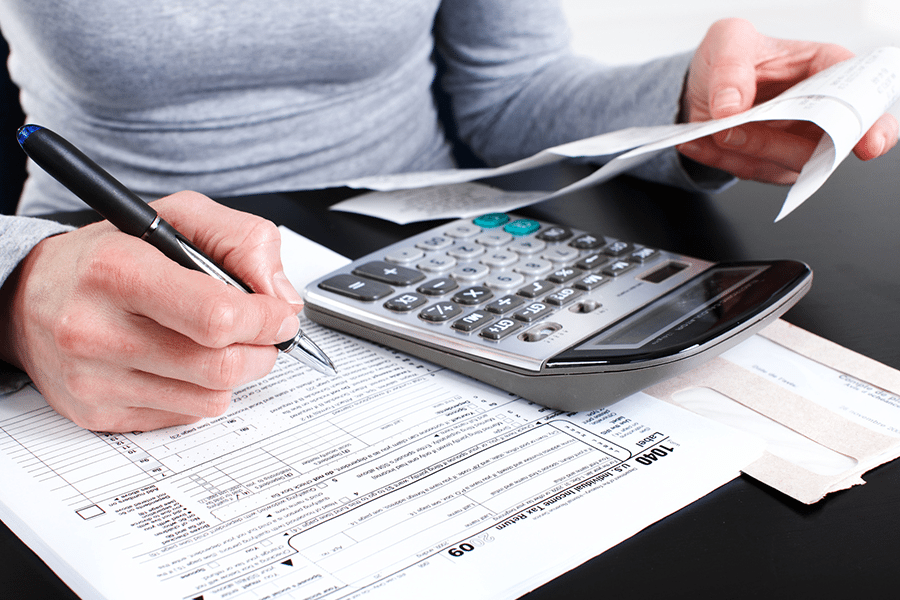

Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. 1 Register for a TaxTim account Tell me a bit about your taxes and Ill show which TaxTim package and price suits your needs best. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

This is how you work it out. This makes your total taxable income amount 27050. It can also be used to help fill steps 3.

Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime. This places US on the 4th place out of 72 countries in the. Its quite easy actually.

This comes to 102750. Your average tax rate. For example if an employee earns 1500.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

To enter your time card times for a payroll related calculation use this time card. SARS Tax Refund Calculator for 2022 Work out how big your tax refund will be when you submit your return to SARS INCOME Which tax year would you like to calculate. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

2 Have a chat with me online Well. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Sage Income Tax Calculator.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. How to calculate annual income.

Tax Calculators Taxtim Sa

Salary Formula Calculate Salary Calculator Excel Template

/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

Salary Calculator Salary Calculator Calculator Design Salary

Salary Formula Calculate Salary Calculator Excel Template

Tax Calculators Taxtim Sa

Tax Calculators Taxtim Sa

The Gov S Pension Empire Center For Public Policy

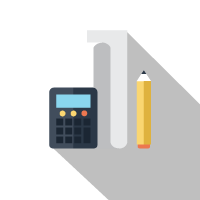

Why Boston Is In Trouble 8 451 Highly Compensated City Employees Paid 100 000 Cost Taxpayers 1 2b

Self Employment Tax 2021 2022 Rates Calculator

10 Financial Benefits For Federal Pharmacists You Wish You Had

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll Services Finance And Budget

Tax Calculators Taxtim Sa

Tax Calculators Taxtim Sa

Tax Tim Taxtim Twitter

Salary Formula Calculate Salary Calculator Excel Template